Last week, I shared with you a post about how the MLB owners got to the wealth point that they were able to become MLB owners. It’s thick with hedge fund billionaires, real estate billionaires, and a couple that did it the old fashioned way and inherited it.

With Tom Ricketts’ “biblical losses” (on the same day his brother, Governor Pete Ricketts of Nebraska called a black pastor “you people”), now must be the time for a sharing of the risk. If players are going to be asked to share in the losses, taking a cut despite guaranteed contracts, then they should also be allowed to share in the gains.

“But players can’t be owners,” you say. You note that no former MLB player has more than fractional ownership and that one of the highest paid athletes of all time, Alex Rodriguez, had his bid for the Mets rejected out of hand because, according to an MLB source, “he doesn’t have close to the amount of capital he’d need and he doesn’t have rich friends willing to let him do what Derek Jeter is doing.”

It’s time to change that.

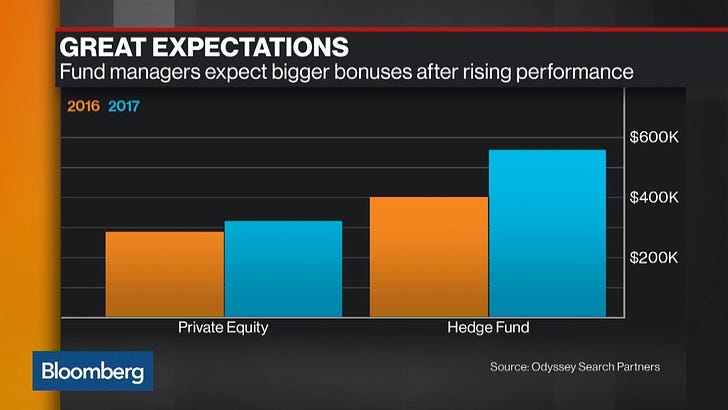

If you watch Billions or The Wolf of Wall Street, you’l know that Wall Street runs on bonuses. Perform and get paid. At bonus time, there’s always ready stories of a rush on the Ferrari dealership, a line at Armani, and real estate prices go appreciably up.

In hedge funds, employees get a bulk of their compensation in the form of performance bonuses. This can be up to 20 percent of profits. Man, those hedge fund fees do add up. There’s other interests, which you can read about here, including a share in the sale of the business.

Owners have long called for some form of bonus compensation to take away from long-term, guaranteed contracts that have become the norm. Rules strictly limit these kind of performance bonuses now, but there’s a collective bargaining agreement coming up and if the players want, this could be a negotiating point.

Say you’re Mike Trout and you’ll take half your contract value in return for a bonus of $3 million per WAR. (The value of a win is about triple that now, so it’s a good deal.) A repeat performance of his 8.9 WAR in 2019 would return about 26 million and having only given up about 19 million in salary, it’s a nice deal for him - $37 million previous, $44 million on bonus.

How many players would be willing to take that kind of deal? Would the owners be willing to risk paying out more but with a guaranteed base of half of what they have now? The Angels make for an interesting case, given that Trout would max out this kind of system, but likely makes little to no difference in ticket sales or playoff performance. This is hardly his fault, but points to a real problem for the owners. Of course, it’s a problem in the current system as well.

(Bonus points for a reader — how many players would come out well under this system? How many teams would come out ‘ahead’ in terms of lowered salary?)

Let’s take it one step further and trade salary for ownership. There’s nothing to stop players from doing exactly what corporate executives do and take a bulk of their compensation in ownership. Elon Musk gets Tesla stock and his compensation is based exclusively on performance. He’s done pretty well.

Lesser known but still top level executives do much the same. Jamie Dimon, the longtime head of JPMorgan Chase, recently negotiated a new deal for himself after the most profitable year in the bank’s history. Of his $31 million annually, only $1.5 million is salary, with the rest in stock and performance based options.

What if Trout could take part of that guaranteed salary and buy in to ownership? We know teams have a value. They have shares, just like any other business, even if none are publicly traded. (The Braves are owned by a public company, but the shares in the team are not traded. In fact, only one team in baseball has public shares - the Indianapolis Indians - but those are not traded on a public exchange and have largely been illiquid for a decade.)

Even if Trout deferred most of his salary into shares wouldn’t dilute Arte Moreno and any partners by much. The value of the Angels is about $2 billion dollars. Let’s split the Angels’ holding company into a million shares. That’s $2,000 a share. Thirty million of Trout’s dollars shift to stock - almost exactly as Dimon did - which gives him 15,000 shares or about 1.5 percent of the team. (That’s a very rough calculation. The more likely scenario would cause new shares of the team to be created but let’s avoid that math for now.)

Again, the players and owners could agree to this kind of voluntary arrangement in the next CBA. An owner would have to agree to sell shares in his team in lieu of salary and a player would have to ‘trade’ salary for ownership, just as Jamie Dimon, Elon Musk, Tim Cook, and other top executives do each year.

If owners really want players to share in the risk, they ought to allow them ownership as well. That’s the American way. Baseball, apple pie, and carried interest on options.